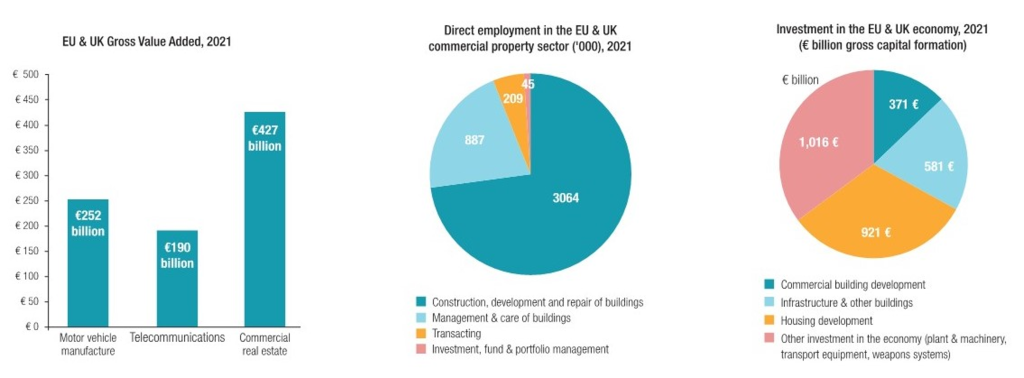

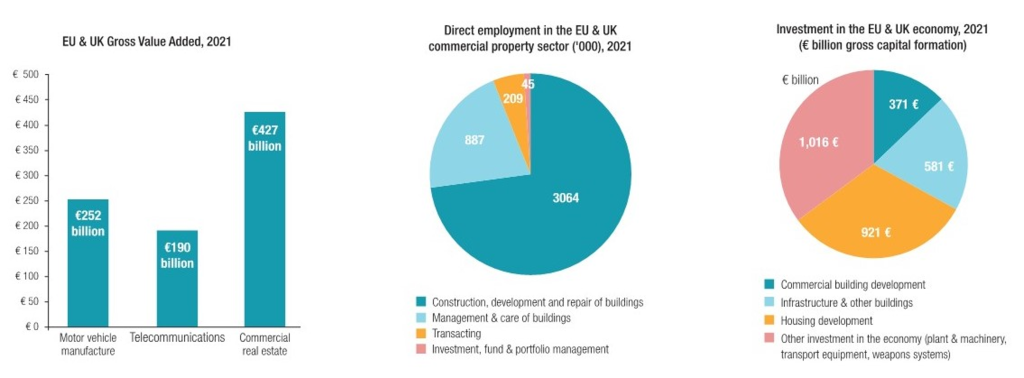

- Commercial property contributed EUR 427 billion to the EU economy in 2021, representing 2.8% of the total European economy

- In 2021 its market value was approximately EUR 8.8 trillion

- Compared to the residential property, with a total value of EUR 29.9 trillion, commercial real estate is relatively small

- Yet commercial real estate alone directly employs over 4 million people in the EU and UK

- Investment in new commercial property buildings and the refurbishment and development of existing buildings increased to EUR 371 billion in 2021 – representing 13% of total investment in the EU and UK economies

- Around 35% of the commercial property is leased to businesses who need the flexibility of renting rather than owning their premises, as such it is a vital factor of production. Investors in commercial real estate often invest long-term, and counter-cyclically, with benefits for the economy

- Long-term investments in real estate help insurance companies and pension funds meet their long-term obligations and contribute to sustainability improvements